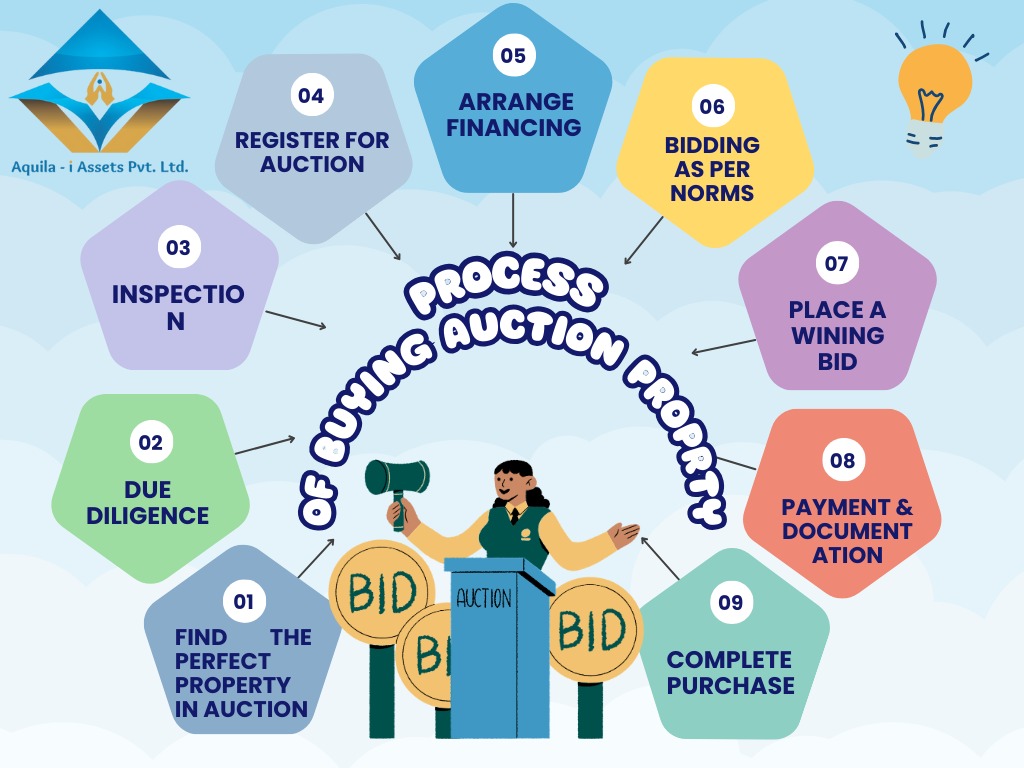

Navigating the Auction Process in Indian Real Estate: A 9-Step Guide

Buying property through an auction can be an exciting opportunity in the Indian real estate market, but it’s crucial to understand the process involved. Whether you’re a seasoned investor or a first-time buyer, knowing the steps can make your journey smoother. Here’s a comprehensive guide to the nine essential steps of the auction process in India.

1. Find the Perfect Property in Auction

The journey begins with identifying the right property. Start by keeping an eye on bank auction notices, which are published in leading newspapers and on the websites of various financial institutions. Many banks list properties under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002. Look for properties that fit your investment criteria, whether you are interested in residential homes, commercial spaces, or land.

Tips:

- Use Online Platforms: Explore dedicated auction websites that aggregate listings from multiple banks.

- Set Criteria: Define your budget, preferred location, and property type to narrow down your search effectively.

2. Due Diligence

Once you've identified potential properties, conducting thorough due diligence is essential. This involves researching the property’s history, legal standing, and any existing encumbrances.

Key Aspects to Investigate:

- Legal Status: Appoint advocate for clearance of titles and verify ownership to avoid potential disputes.

- Pending Dues: Investigate if there are any outstanding loans, property taxes, or maintenance fees associated with the property.

- Market Value: Compare similar properties in the area to assess whether the reserve price is justified.

3. Inspection

Whenever possible, inspect the property in person. This will give you a clearer idea of its condition and help you gauge any necessary repairs or renovations. If physical inspection isn’t feasible, consider seeking reports or opinions from real estate professionals.

What to Look For:

- Structural Integrity: Look for signs of damage or required repairs, such as water damage, cracks, or pest infestations.

- Surroundings: Evaluate the neighbourhood, access to amenities, and overall environment to ensure it aligns with your needs or investment goals.

- Documentation: Request any available reports on property assessments or previous valuations.

4. Register for Auction

To participate in the auction, registration is necessary. This typically involves submitting identification documents and paying an earnest money deposit, which is usually a percentage of the property’s reserve price.

Steps to Register:

- Contact the Auctioneer: Reach out to the bank or auction platform for specific registration requirements.

- Prepare Documents: Commonly required documents include identity proof, address proof, and PAN card.

- Earnest Money Deposit: Ensure you have the necessary funds ready to secure your position in the auction.

5. Arrange Financing

Securing financing before the auction is crucial, as it prepares you for the financial commitment required if you win the bid. Many banks offer specific loans for auctioned properties, but the process can be different from standard home loans.

Steps to Register:

- Pre-Approval: Seek pre-approval from your lender to understand your borrowing capacity.

- Compare Options: Evaluate different financing options, including interest rates and repayment terms.

- Budgeting: Calculate all potential costs, including the earnest money deposit, full purchase price, and additional fees.

6. Bidding as per Norms

Understanding the auction norms is essential for successful bidding. Auctions can be highly competitive, and having a strategy in place can make all the difference.

Bidding Strategy:

- Set a Maximum Bid: Determine your upper limit based on your budget and stick to it.

- Observe Patterns: Pay attention to bidding patterns during the auction to gauge the competition.

- Stay Composed: Maintain your composure; avoid getting caught up in the excitement and overbidding.

7. Place a Winning Bid

When the auction commences, be prepared to place your bids confidently. The highest bidder at the end of the auction is declared the winner.

Winning Tips:

- Be Ready to Act: Have your bid amount ready and make sure you can act quickly when you’re ready to place a bid.

- Stay Informed: Keep track of the current highest bid to ensure you remain competitive.

8. Payment & Documentation

After winning the bid, you’ll receive a sale certificate from the bank, confirming your ownership rights. Follow the payment timeline outlined in the auction notice to complete the transaction.

Important Steps:

- Payment Timeline: Be aware of deadlines for the full payment, which typically follows soon after the auction.

- Gather Documentation: Ensure you have all necessary documents, including the auction notice and sale certificate, for future reference.

9. Complete Purchase

The final step is to complete the purchase by transferring the property title into your name. This involves a series of legal formalities and payments.

Steps to Finalize the Purchase:

- Title Transfer: Initiate the process of transferring the title by submitting necessary documents to the local registrar.

- Clear Dues: Settle any outstanding dues or taxes related to the property.

- Possession: Understand when you can take possession of the property and plan accordingly.

Important Considerations

While the auction process can yield significant opportunities, several important factors warrant your attention:

- Legal Advice: Engaging a lawyer can help navigate the complex legal landscape, ensuring all documentation is in order.

- Hidden Costs: Be mindful of additional costs, including stamp duty, registration fees, and potential repairs.

- Market Research: Continuously evaluate the real estate market trends to make informed decisions about your investment.

- Post-Purchase Responsibilities: Be prepared to manage ongoing responsibilities, such as property maintenance and taxes.

Conclusion

Participating in property auctions can be an exciting yet challenging endeavor. By following these nine detailed steps, you can navigate the auction process in the Indian real estate market with greater confidence. With thorough preparation and research, you’ll be well on your way to securing your ideal property. Happy bidding!

How To participate in a bank e-auction. (2023). October 1, 2024

https://www.eauctionsindia.com/blog-details/how-to-participate-in-a-bank-e-auction